FAQ on Pecunia web app (PWA)

This FAQ is designed to help lenders understand how Pecunia works. It ia a complete guide to running a digital lending business with Lendsqr.

FAQ on white-label app

In this article, we’ll answer common questions lenders often have about the white-label app so you can understand exactly how it works and how it can fit into your lending operations.

FAQ on Lender web app

The Lender Web App is Lendsqr’s white-label platform that lets lenders manage lending under their own brand. This guide answer questions to help you run your microsite.

Lendsqr vs Geesoft as a loan management software in Zimbabwe

Platforms like Lendsqr and Geesoft have emerged, offering solutions to automate disbursements, monitor repayments, and enhance risk management.

Lendsqr vs Simbuka as a loan management software in Rwanda

In the end, the best LMS isn’t just the one that gets the job done; it’s the one that prepares you for what’s next.

Best loan management software for Ghanaian lenders: Lendsqr vs. Business Warrior

Without the right LMS, managing loans can get messy, risky, and downright exhausting. With it, things get a whole lot smoother.

Lendsqr vs Voxforem Technologies as a loan management software in Zambia

It’s an enlightening moment when you realize you need a loan management system to scale your business, and with it comes the burden of choice: Lendsqr vs Voxforem?

Lidya vs Evolve Credit vs Lendsqr

After exploring each of these platforms thoroughly, here's how the Lidya vs. Evolve Credit vs. Lendsqr showdown turned out.

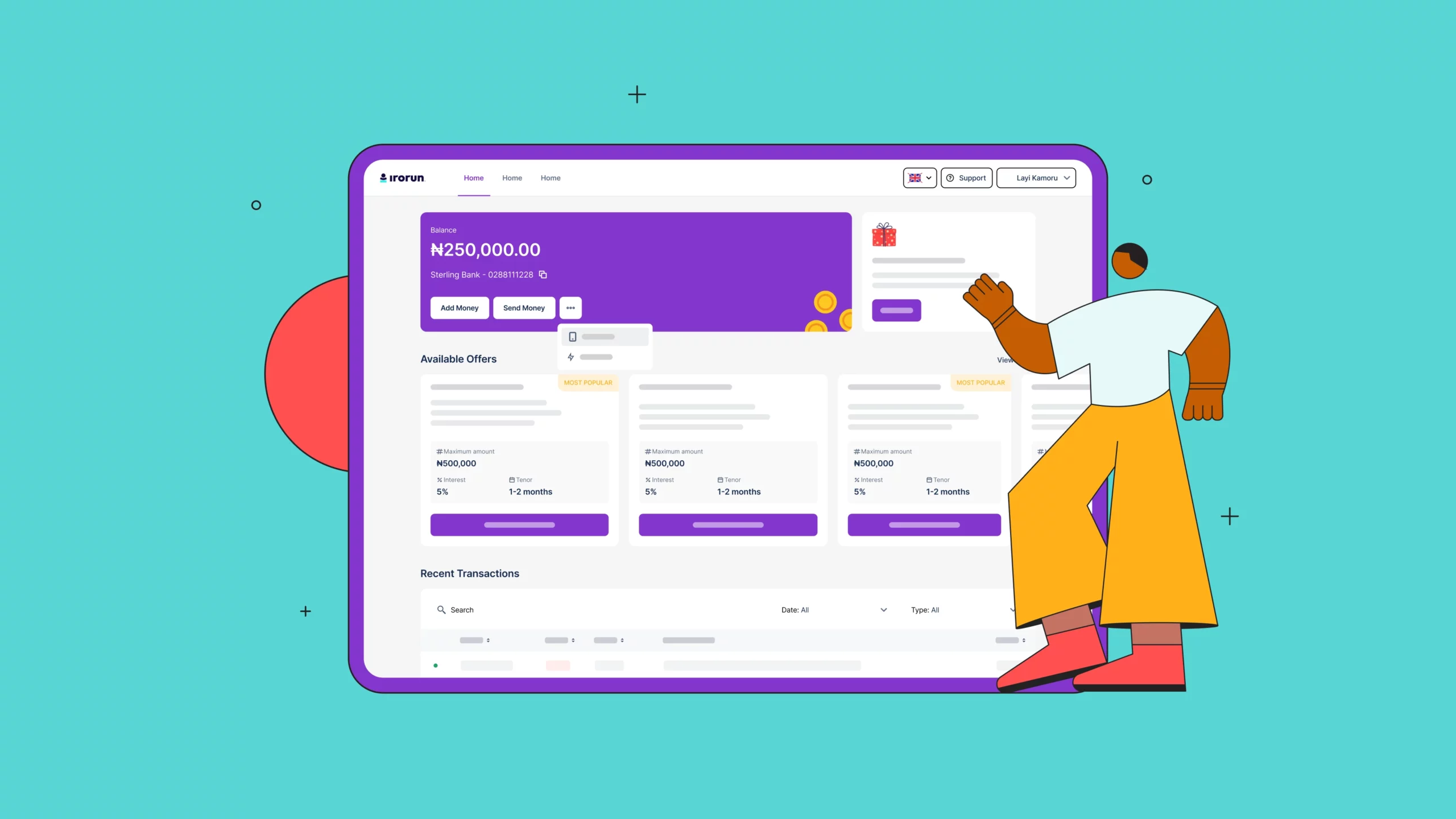

Why we built our lenders’ web app and how it has changed lending forever

“It’s going to change lending forever and we’re not ashamed to say we will be the ones to do that.” Adedeji Olowe, Founder, Lendsqr

How Kolo simplifies expense tracking across multiple bank accounts

No matter the amount of personal or company accounts you have, Kolo can help you handle them all.

How we built our URL shortener (Monstrator) as a replacement for Bitly

Monstrator stands as a testament to our in-house development capabilities, demonstrating our ability to solve critical business problems with custom-built solutions.